Unknown Facts About Top 30 Forex Brokers

Unknown Facts About Top 30 Forex Brokers

Blog Article

Getting My Top 30 Forex Brokers To Work

Table of ContentsOur Top 30 Forex Brokers DiariesSome Known Questions About Top 30 Forex Brokers.All About Top 30 Forex BrokersLittle Known Facts About Top 30 Forex Brokers.Our Top 30 Forex Brokers StatementsAll About Top 30 Forex BrokersTop 30 Forex Brokers for BeginnersThe Ultimate Guide To Top 30 Forex Brokers

Like other circumstances in which they are used, bar graphes offer even more price info than line charts. Each bar chart stands for someday of trading and has the opening price, highest cost, least expensive price, and shutting rate (OHLC) for a trade. A dashboard on the left represents the day's opening cost, and a comparable one on the right represents the closing cost.Bar charts for currency trading assistance investors identify whether it is a buyer's or vendor's market. Japanese rice investors first utilized candlestick graphes in the 18th century. They are visually much more attractive and easier to check out than the chart types explained over. The top portion of a candle is utilized for the opening cost and greatest cost factor of a money, while the reduced portion shows the closing rate and most affordable cost point.

Top 30 Forex Brokers for Dummies

The formations and forms in candle holder graphes are made use of to recognize market instructions and motion.

Banks, brokers, and dealerships in the forex markets allow a high amount of leverage, meaning investors can regulate large placements with reasonably little money. Leverage in the series of 50:1 is common in foreign exchange, though even greater quantities of utilize are readily available from specific brokers. Leverage has to be utilized very carefully because several unskilled traders have actually experienced significant losses using even more utilize than was essential or sensible.

Fascination About Top 30 Forex Brokers

A money investor needs to have a big-picture understanding of the economic situations of the various countries and their interconnectedness to comprehend the principles that drive currency values. The decentralized nature of forex markets indicates it is much less controlled than other financial markets. The degree and nature of law in forex markets depend on the trading jurisdiction.

The volatility of a certain money is a function of multiple factors, such as the politics and business economics of its nation. Occasions like economic instability in the form of a settlement default or inequality in trading partnerships with one more money can result in substantial volatility.

Some Ideas on Top 30 Forex Brokers You Should Know

Money with high liquidity have a prepared market and exhibit smooth and foreseeable price activity in response to exterior events. The United state dollar is the most traded money in the globe.

Top 30 Forex Brokers Things To Know Before You Buy

In today's details superhighway the Forex market is no more only for the institutional investor. The last 10 years have seen a rise in non-institutional investors accessing the Forex market and the benefits it offers. Trading platforms such as Meta, Prices Estimate Meta, Investor have actually been developed especially for the personal capitalist and instructional material has become much more easily offered.

Indicators on Top 30 Forex Brokers You Need To Know

International exchange trading (foreign exchange trading) is a global market for getting and marketing money - icmarkets. 6 trillion, it is 25 times bigger than all the world's stock markets. As an outcome, prices alter continuously for the currencies that Americans are most likely to make use of.

When you market your money, you get the settlement in a different money. Every vacationer who has obtained foreign currency has done forex trading. The investor purchases a certain money at the buy rate from the market manufacturer and offers a different currency at the marketing price.

This is the deal cost to the trader, which subsequently is the profit gained by the market maker. You paid this spread without recognizing it when you traded your bucks for international currency. You would certainly notice it if you made the transaction, terminated your trip, and afterwards attempted to trade the currency back to bucks today.

Top 30 Forex Brokers Fundamentals Explained

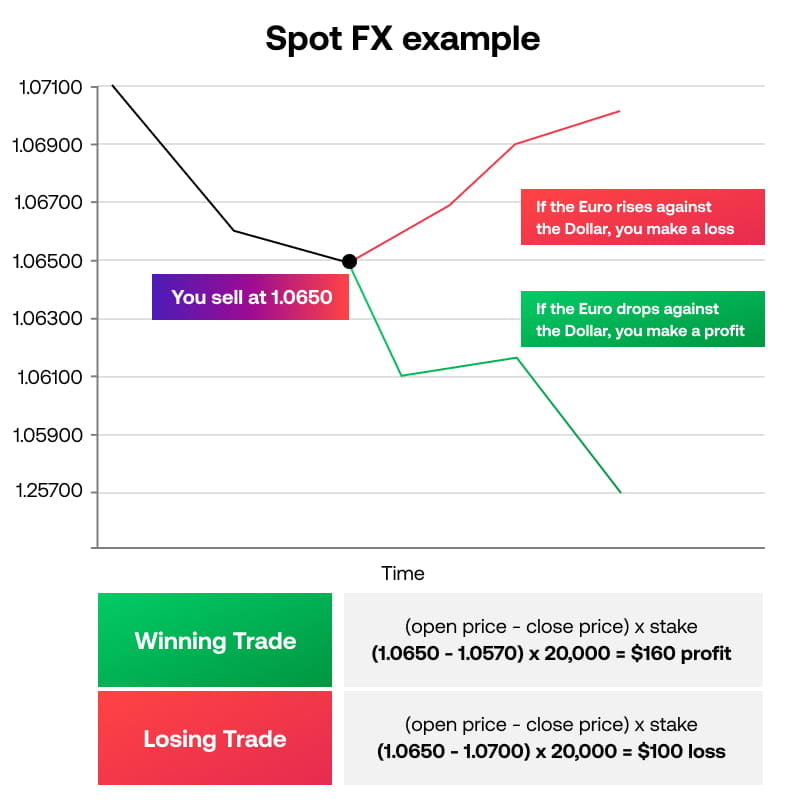

You do this when you think the currency's value will fall in the future. Organizations short a currency to safeguard themselves from risk. But shorting is extremely high-risk. If the currency climbs in value, you need to acquire it from the supplier at that cost. It has the exact same pros and cons as short-selling stocks.

Report this page